Freshers' Guide To Managing Finance In DU: From Canteen Bills To Study Materials

Pragati Sharma

Published on 2/13/2025

Manage finances as a fresher in Delhi University is all about stretching the budget and making smart choices. It takes you from daily canteen expenses to buying study materials and shows you the way through it. The guide has practical tips on saving, budgeting, and prioritizing essentials on how to balance fun with financial responsibility. You will find out how to appreciate Delhi's culture, learn to live off of your student allowance, and get into a routine of self-sustainability. Be proud of beginning your journey with the pride of the prestigious Delhi University, and feel free in knowing that every rupee counts.

Congratulations! You're on board the DU Family!!! It's time you enter into this chapter-now remember taking charge of finances so early is the game plan. This guide focuses on freshers where the process towards managing expenses takes the practical step-by-step towards your resources for achieving financial stability.

Taking a charge of money so that one can really get the experience to be the best at universities. Let's dive in!!

\n

Table Of Contents:-

\n- \n

- Introduction

- 1. Budget Diary

- 2. Be Smart With Your Choice Of Food

- 3. Affordable Tourism In Delhi

- 4. Shoestring Budget Movie Dates

- 5. Low Cost On Study Materials And Stationery

- 6. Use All Library Facility Available

- 7. Utilize Free Or Low-Cost Workshops & Seminars

- 8. Part-Time Jobs And Internships

- Other Success Financially

- Conclusion \n

Introduction

The exciting journey of self-discovery with university life brings new challenges to the student's life. Some of the big problems one experiences are learning to manage money and be completely independent in making decisions alone. Saving money and being careful about the way it is spent would not only be helpful in your college years but in your later life as well.

The following are strategies and some tips on managing finances here at DU:

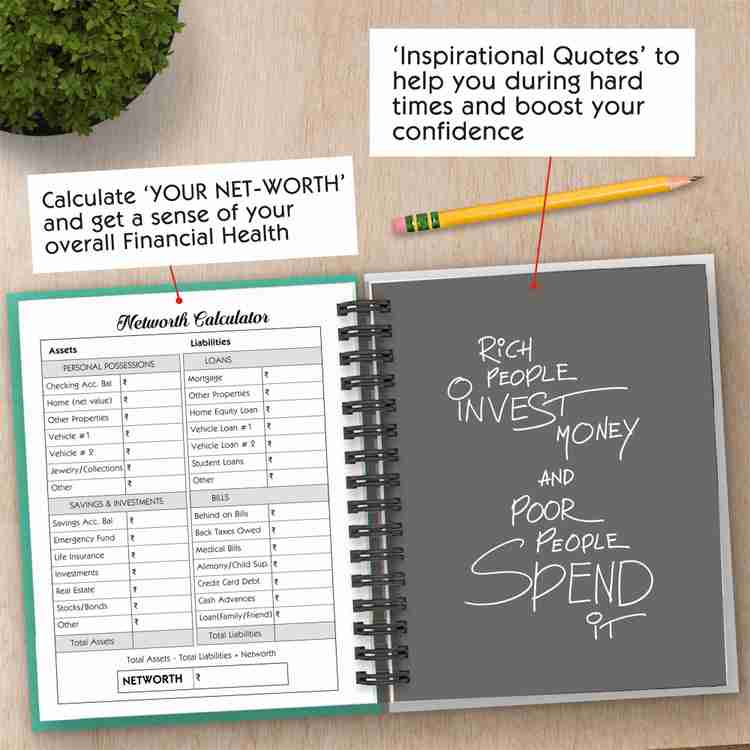

1. Budget Diary

Keep a monthly budget. Write down in a diary your income sources, the monthly budget, and your expenses. You will track all of the estimated expenses at the beginning of the month so that there would be no surprise regarding the expenses.

You have to start saving Rs 1000 to Rs 2000 for emergency needs-such an amount can be useful when urgent medical needs or sudden requirements for academic purposes arise. For transport, you'd have to save about Rs 1000 a month on metro travel. Find out the nearest metro station from your college so you can walk instead of going through rickshaws and taxis, and so avoid up to Rs 20 per ride. Besides, keep aside Rs 500 for conveyance emergencies. Ladies students, you may opt for the free bus ride schemes that the Delhi government offers so you avoid saving on travelling.

2. Be Smart With Your Choice Of Food

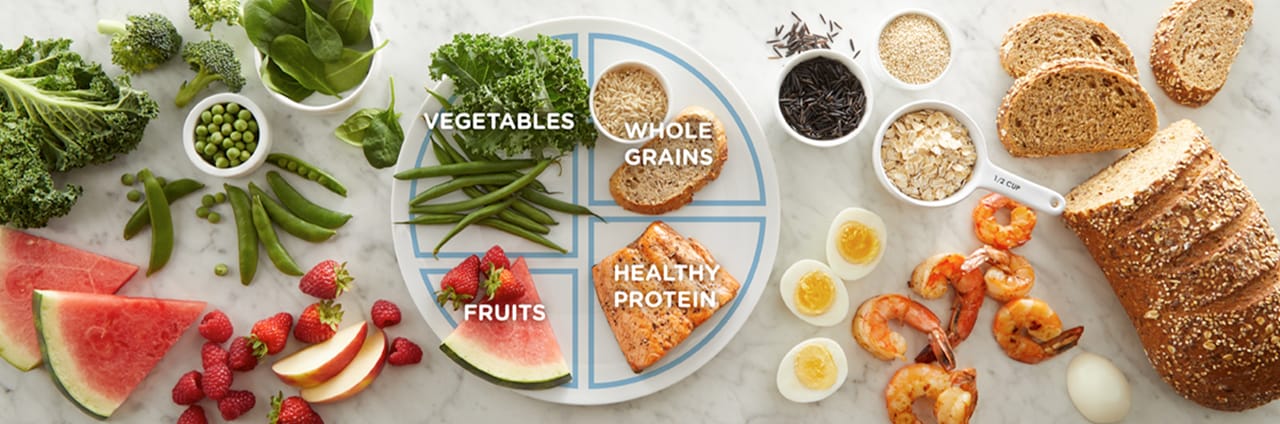

Actually, eating out can be pretty costly-not to mention if you spent every day at the college cafeteria. Cut that off with the possible help of taking a lunch that was packed from home as often as you can. In addition, this will be saving you money and feeding you healthier than what would be sold in canteens. All this is fair; and the money so saved from canteen meals could be splurged over a trip or two at a friend or friends to the local cafes over a cup of coffee, just so long as you treat that as an occasional instead of a regular habit. The reason is that such bills at the cafe or restaurant tend to bleed from the pocket if spent carelessly.

3. Affordable Tourism In Delhi

Delhi is congested with so many attractions that most of them are free or cost only a few rupees. Look for free admission places, such as museums, public gardens, and historical places. Affordable commodities and street food abound in its markets, which makes Delhi an excellent fun destination without overspending much.

Another good one is university activities; the best thing about such events is that they cost next to nothing, simply because it is free to the students of the universities. Such events include thrilling games, live performances, and food and drink stalls. Do not forget to attend university feasts and cultural festivals!

4. Shoestring Budget Movie Dates

Watching movies is the favorite pastime for many. However, it does not need to be pricey. Plan to spend at least the lowest possible monthly amount of Rs 100 to Rs 200 towards cinema dates. You would attend early morning shows only since those are much costlier than the shows which take place in the noon or evening. You desist from visiting cinemas from expensive malls because they will make you pay more money by way of ticket. Then, search for the one that is nearer to the college. Apart from the entrance fee, you will also save on transport too.

5. Low Cost On Study Materials And Stationery

When learning, the books and other study materials are so costly. Here, some of the tips in lowering the cost include purchasing photocopies of only parts from books you need or second-hand books. You can save much money by downloading many of your books free or at a very cheap rate as PDFs and e-books. Sharing books among friends is another way of saving.

If you have to purchase books in print, visit the Mahilla Maat Daryaganj market on Sundays or the Tilak Nagar market on those days when Wednesdays do not fall. Another practical advice is the buying of stationery in lots. Do not waste money on frills but some basic supplies are available from local shops or the college store at cheaper prices.

6. Use All Library Facility Available

You, a student of DU, has your college library, it is a facility to take free textbooks and reference books through your student ID cards. This can save you money in books, so do find out what the libraries might offer before buying study material. Apart from that, libraries mostly have digital versions of books and other researched papers available online. Having a full utilization of a college library would limit what you need to purchase books for or even photocopy.

7. Utilize Free Or Low-Cost Workshops & Seminars

Delhi University runs workshops, seminars, and guest lectures on almost all subjects. All of these are either free or at a very low cost and make excellent learning places or ways to fill in the gaps in knowledge. And of course, they are fabulous places to meet people and make contacts without spending too much money. Refreshments or study materials are available during most of the sessions, which makes them quite inexpensive for students looking to gain some extracurricular enrichment.

8. Part-Time Jobs And Internships

Not all students can afford their part-time jobs or participate in internships; still, they are extremely good for supplementing one's income. Students of Delhi have a lot of other work opportunities available to them like being an intern, teaching private classes, content writing or freelancing. Not only do they earn some pocket money but also learn great experience and new skills while doing so. Check for job openings on some of the job boards, student networks, and the following websites: Internshala, LinkedIn, DU job fairs, among others. There should be a balance between working and studying so as not to cause any academic stress unnecessarily.

Other Success Financially

Negotiate Confidently: Never be afraid to negotiate when buying from the vendors, especially in the markets of Delhi. The people here negotiate frequently, and you can get a lot off by just asking. Needs come before wants. It is easy to get caught up in what's currently trending, but keeping a grip on what you truly need while trying to curb impulsive buys will keep you better suited to the budget. Think twice before buying on whims.

Seek Financial Aid and Support: Delhi University also offers aid to the students with different aids as students face financial problems accompanied by academic challenges. Support organizations include the Delhi University Students' Union, the University Counseling and Guidance Centre, as well as the Financial Aid Office. These bodies have support and advice whenever anyone may need them. Healthy finance is maintaining financial health at optimum levels, which translates into having money for when and where it is required. This however, is going to be overwhelming at times when handling finances as a student of the university. Continuous efforts make it second nature, though.

Conclusion

College is learning new things and helping build habits that will enable one to move through all parts of life. Taking responsibility over your finances is a key step in this way of life. Good spending decisions, wise budgeting, and evaluating the resources you can access in your lifetime ensure that you enjoy the university experience without too much financial stress.

Check Out Our Official Insta Handle -https://www.instagram.com/dustudenthelper/

Join us again for more exclusive content and expert guidance—only on DU Student Helper - Your Ultimate Study Companion!

Tags

Share this article

Subscribe to Newsletter

Get the latest updates and resources delivered to your inbox.